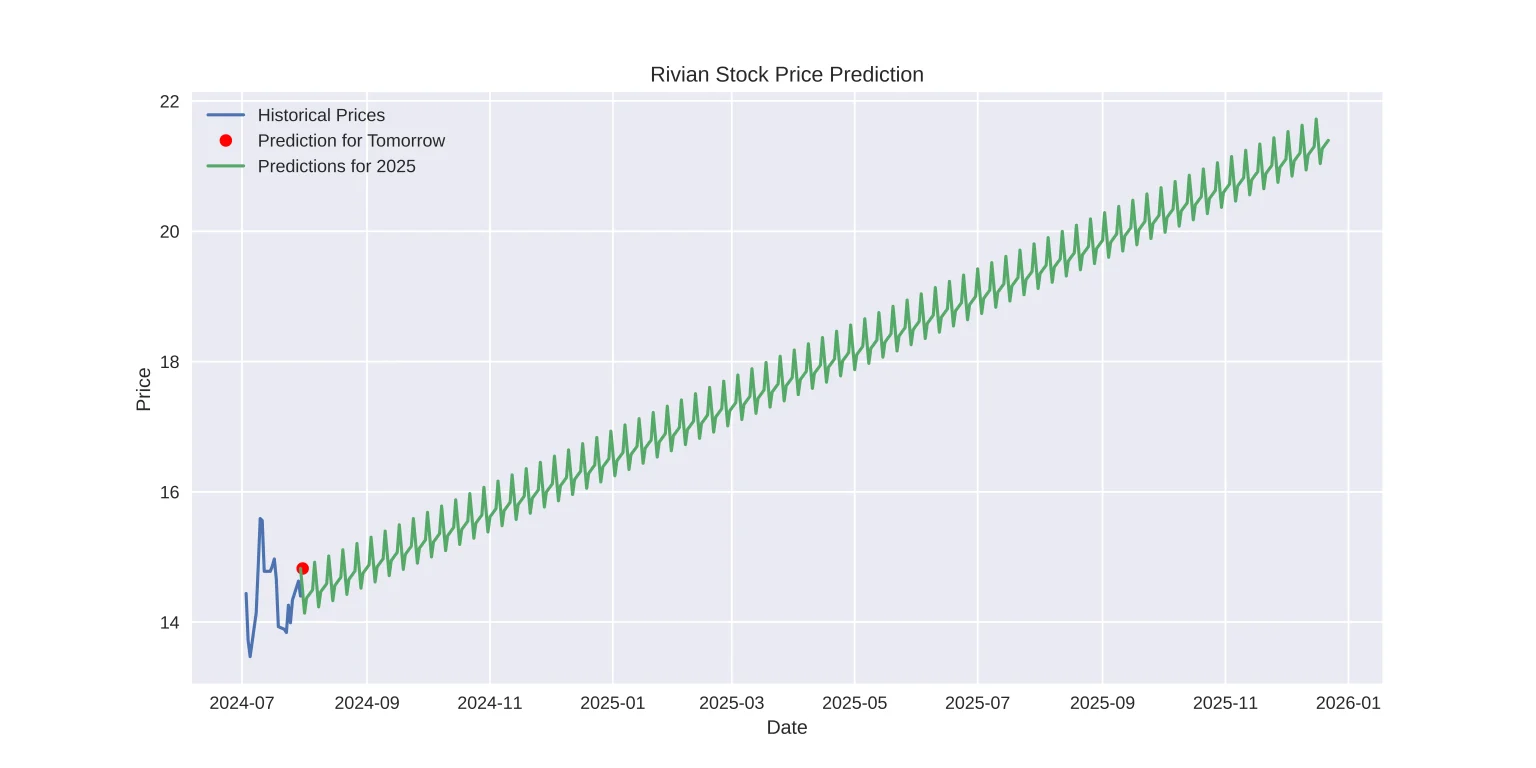

Rivian Automotive, Inc. (RIVN) has been on a bullish trajectory, closing at $13.92 yesterday. This marks a $3 increase from 30 days ago and $2.91 from just a week ago. With a remarkable rise in just a short period, investors are curious about what lies ahead.

Short-Term Forecast:

For the next few days, Rivian’s stock is expected to maintain its upward momentum. Here’s a snapshot of the anticipated price movements:

- July 3: $14.44 (Min: $13.28, Max: $15.60)

- July 4: $13.72 (Min: $12.62, Max: $14.82)

- July 5: $13.47 (Min: $12.39, Max: $14.55)

Weekly Outlook:

By next week, the stock could see significant fluctuations, with a high forecast of $16.84 on July 10, reflecting strong investor confidence and market conditions.

Long-Term Projections:

Looking ahead to 2025, Rivian’s stock is forecasted to experience substantial growth:

- January 2025: $19.03 (Min: $17.51, Max: $20.55)

- July 2025: $28.42 (Min: $26.15, Max: $30.69)

- December 2025: $39.73 (Min: $36.55, Max: $42.91)

This consistent upward trend reflects Rivian’s potential to capitalize on the expanding electric vehicle market, innovative product offerings, and increasing production capabilities.

Conclusion:

While the short-term outlook for Rivian suggests potential volatility, the long-term forecast indicates promising growth, making it a stock to watch for both current and potential investors. With projections reaching as high as $49.10 by mid-2026, Rivian remains a compelling choice in the EV sector.

| Date | Min | Max | Price |

|---|---|---|---|

| 07/03/2024 | 13.28 | 15.60 | 14.44 |

| 07/04/2024 | 12.62 | 14.82 | 13.72 |

| 07/05/2024 | 12.39 | 14.55 | 13.47 |

| 07/08/2024 | 13.01 | 15.27 | 14.14 |

| 07/09/2024 | 13.66 | 16.04 | 14.85 |

| 07/10/2024 | 14.34 | 16.84 | 15.59 |

The stock’s performance will hinge on market conditions, Rivian’s operational milestones, and broader economic factors. Investors are advised to stay updated with market analyses and company reports to make informed decisions.