In the growing world of cryptocurrency, many websites claim to offer secure and easy trading. Anti-Dex.com is one such platform, but is it trustworthy? Let’s explore its features, warnings, and whether it’s worth your trust.

What is Anti-Dex.com?

Anti-Dex.com says it’s a modern crypto exchange offering tools for trading, staking, and NFT transactions.

It claims features like over 70 cryptocurrencies, low fees, secure peer-to-peer (P2P) trading, and customizable APIs.

The platform also highlights strict security measures, like Anti-Money Laundering (AML) rules.

Our Review

At first glance, it looks like a promising place to manage your crypto investments. But behind the shiny features, there are concerns you should consider.

The domain details raise questions. It was registered on September 12, 2024, and will expire in just one year. Scam websites often use short domain lifespans to disappear quickly before complaints pile up.

User reviews are another red flag. Some users report issues like delayed withdrawals, poor customer support, and even missing funds. These problems are common with scam platforms pretending to be reliable.

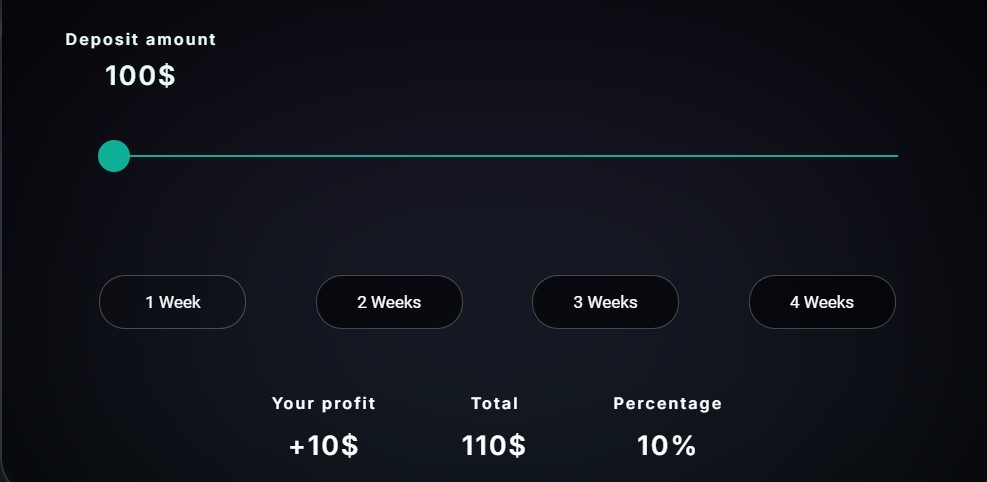

The platform’s promises, like “10% profit in one week,” sound too good to be true. Cryptocurrency markets are risky, and no legitimate platform guarantees returns like this.

Payment issues also stand out. Users say transactions sometimes get flagged for no reason, leading to locked accounts and lost money.

Finally, the platform’s security claims seem weak.

While Anti-Dex.com talks about AML and KYC (Know Your Customer) policies, users have reported lax verification processes, which raise doubts about how seriously it takes your safety.

Anti-Dex.com might look professional and offer tempting features, but the short domain life, negative user reviews, and false promises make it look suspicious.

Be cautious and do thorough research before using platforms like this.

What to Do If You Get Scammed?

If you suspect you’ve been scammed by Anti-Dex.com, act quickly:

- Stop further transactions. Avoid sending additional funds or engaging further with the platform.

- Document evidence. Collect screenshots, emails, and transaction records to support your case.

- Report to authorities. File a complaint with local law enforcement or a cybersecurity agency specializing in online fraud.

- Inform your financial institutions. If you used credit/debit cards or bank accounts, notify your bank to dispute charges and secure your accounts.

- Warn others. Share your experience on forums and review platforms to help others avoid falling victim.

Coursiv says it’s an AI-powered challenge that helps people reach financial freedom.